Last updated: February 04, 2025

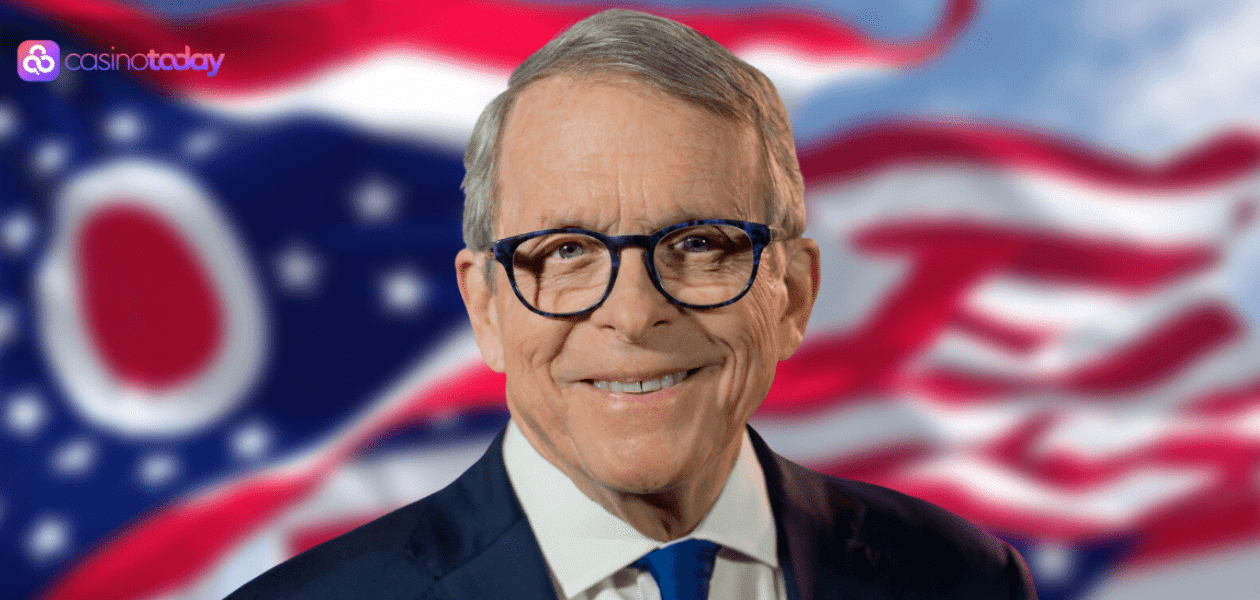

Ohio Governor Mike DeWine has proposed a 40% tax on sports betting operators, doubling the current rate and marking a 400% increase since 2023. The additional tax revenue, estimated at $130M–$180M annually, would help fund a new stadium for the Cleveland Browns and support youth sports.

Ohio Governor Mike DeWine released his final budget plan on Monday (3 February) and it includes increasing the legalized sports betting tax on operators to 40%.

It would be the second time since July 2023 that the tax has increased if the state legislature approves it. In 2023, DeWine pushed through a budget that increased the tax from 10% to 20%. That brought Ohio from a pro-gambling tax regime to one near the upper end of the scale.

If the tax is increased to 40%, it would make Ohio the second-most expensive competitive market for wagering operators. The highest rate is 51% in New York. And last summer, Illinois Governor JB Pritzker opened the door to an increase in the tax in his state. Pritzker originally sought more than doubling the 15% tax to 35%. But lawmakers took it a step further, establishing a sliding scale from 20% to 40%. The highest-revenue firms pay at the higher end of the scale.

“We knew since day one DeWine has despised sports betting,” said gambling consultant Brendan Bussmann to iGB. “He apparently failed Economics 101. Certainly a head-scratcher for a Republican that consistently thinks doubling the tax on a business not once, but twice, is a reasonable solution.”

Ohio Capital Journal reports DeWine wants to increase the wagering tax to pay for a new “Sports Construction & Education Fund” and youth sports. The fund’s first application would be to pay for a new stadium for the Cleveland Browns. The NFL team is currently suing the city of Cleveland for the right to relocate its stadium to the suburbs.

Ohio possesses what is generally known as the “Modell law.” In accordance with the Capital Journal, the law is “designed to make it more difficult for sports teams to leave taxpayer-subsidized stadiums in their home cities.”

“They’re aggressive sports gaming [groups].…. They’re in your face all the time,” DeWine told the Capital Journal. “They’re getting Ohioans to lose enormous amounts of money year after year and it seems to me only just and equitable that some of the stadiums be funded by them or part of it.”

The budget plan makes clear that the tax increase would bring between $130 million (£105 million/€126 million) and $180 million in annual new tax revenue.

All the major US sportsbooks are already live in Ohio. Such organizations include BetMGM, DraftKings, Fanatics Sportsbook, and FanDuel, all of which are part of the Sports Betting Alliance (SBA).

“This would be a 400% tax increase in two years,” SBA vice president Scott Ward told iGB. “Respected American businesses, which work closely with state regulators, should not be intimidated by the government increasing their taxes at whim by outrageous amounts. But that is exactly what is happening here in Ohio to sports betting consumers.

“This proposal will inevitably provide substandard products to customers, discourage investment through sportsbooks’ community partners, and leave much less money for future responsible gaming efforts.”

Ward continued that a big increase in taxes would “give a huge advantage to unregulated and offshore applications.” These businesses do not pay state taxes and sometimes don’t even provide responsible gambling tools. So, their prices are lower, and they can provide superior odds and products to customers.